Just How Livestock Risk Protection (LRP) Insurance Can Secure Your Livestock Financial Investment

Animals Risk Security (LRP) insurance coverage stands as a reliable shield against the unpredictable nature of the market, using a calculated method to safeguarding your assets. By delving into the intricacies of LRP insurance coverage and its diverse advantages, livestock producers can strengthen their financial investments with a layer of safety that goes beyond market variations.

Understanding Animals Danger Security (LRP) Insurance Coverage

Recognizing Livestock Risk Security (LRP) Insurance policy is crucial for livestock producers aiming to reduce financial threats related to cost variations. LRP is a government subsidized insurance coverage product designed to secure manufacturers against a decrease in market prices. By giving insurance coverage for market value declines, LRP helps producers secure in a flooring price for their livestock, guaranteeing a minimum degree of earnings no matter market variations.

One key facet of LRP is its flexibility, permitting producers to customize protection degrees and policy lengths to suit their specific needs. Producers can pick the variety of head, weight array, coverage price, and protection period that align with their production objectives and take the chance of tolerance. Understanding these personalized choices is crucial for producers to efficiently handle their cost risk exposure.

In Addition, LRP is available for various animals types, including cattle, swine, and lamb, making it a flexible risk monitoring tool for animals producers throughout different sectors. Bagley Risk Management. By familiarizing themselves with the details of LRP, manufacturers can make enlightened decisions to safeguard their financial investments and make sure monetary security when faced with market unpredictabilities

Benefits of LRP Insurance Policy for Animals Producers

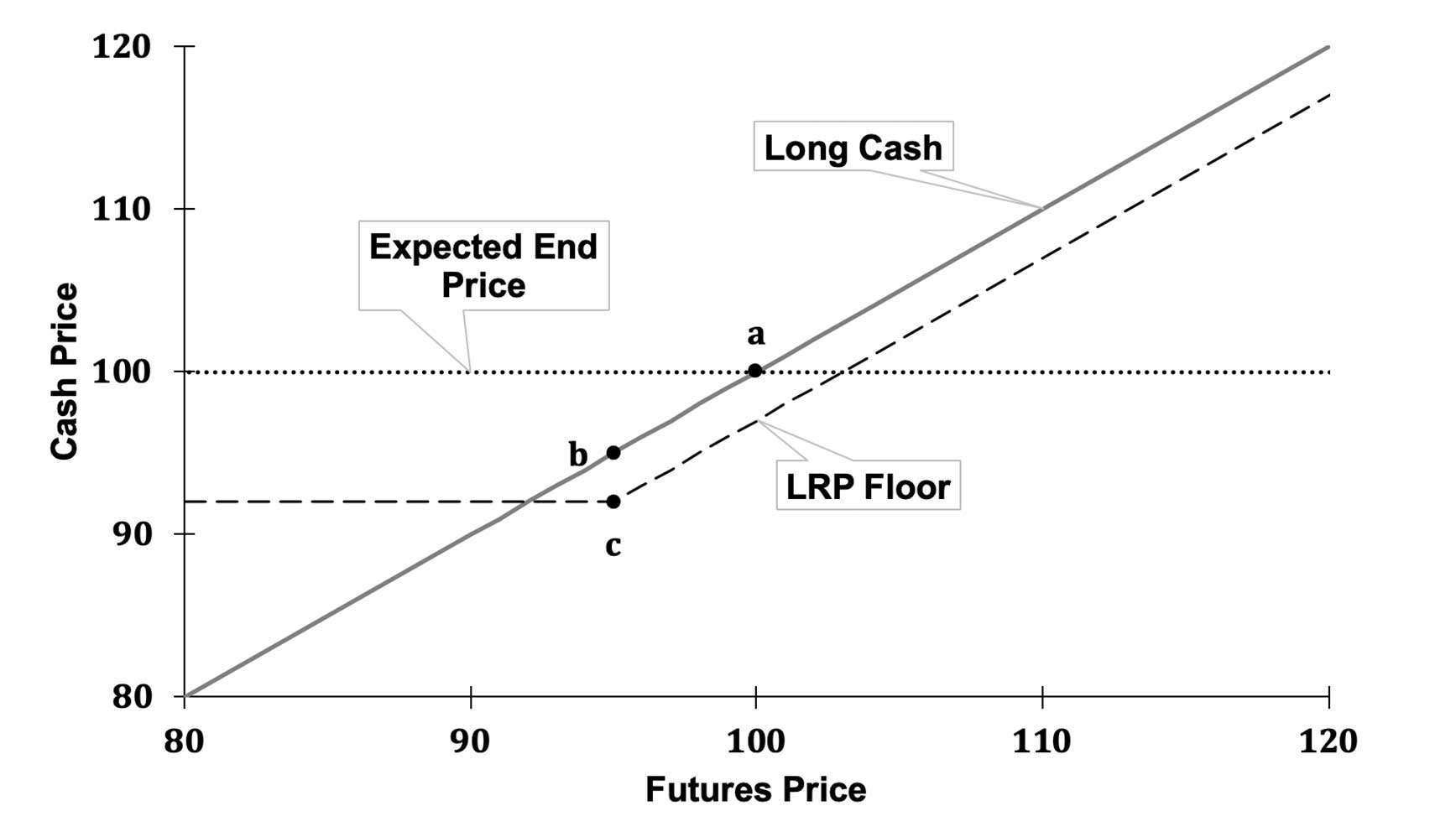

Livestock manufacturers leveraging Animals Risk Security (LRP) Insurance coverage get a calculated benefit in shielding their financial investments from cost volatility and safeguarding a steady monetary ground in the middle of market uncertainties. One key advantage of LRP Insurance is price security. By establishing a flooring on the price of their animals, manufacturers can alleviate the risk of significant financial losses in the occasion of market slumps. This enables them to plan their spending plans better and make notified decisions concerning their procedures without the consistent anxiety of cost changes.

Furthermore, LRP Insurance policy offers manufacturers with peace of mind. Recognizing that their financial investments are guarded versus unanticipated market modifications allows producers to concentrate on other aspects of their organization, such as boosting animal health and wellness and welfare or optimizing production processes. This peace of mind can cause raised efficiency and profitability over time, as manufacturers can operate with even more self-confidence and security. Overall, the advantages of LRP Insurance coverage for livestock producers are significant, offering a beneficial tool for handling risk and ensuring monetary safety in an uncertain market setting.

Exactly How LRP Insurance Coverage Mitigates Market Risks

Mitigating market risks, Animals Threat Security (LRP) Insurance policy gives livestock manufacturers with a dependable shield against rate volatility and economic unpredictabilities. By offering security against unanticipated cost drops, LRP Insurance coverage aids manufacturers safeguard their investments and preserve financial stability despite market variations. This kind of insurance enables livestock producers to secure a rate for their animals at the beginning of the official statement policy duration, ensuring a minimal rate degree no matter market changes.

Actions to Secure Your Livestock Investment With LRP

In the world of farming risk monitoring, executing Animals Danger Security (LRP) Insurance policy entails a tactical process to guard financial investments against market variations and uncertainties. To safeguard your animals financial investment properly with LRP, the initial action is to assess the particular threats your procedure faces, such as cost volatility or unexpected weather condition occasions. Next off, it is important to research study and choose a credible insurance coverage carrier that offers LRP plans customized to your animals and company requirements.

Long-Term Financial Safety With LRP Insurance

Guaranteeing sustaining economic security via the application of Livestock Threat Protection (LRP) Insurance coverage is a sensible long-lasting approach for agricultural producers. By incorporating LRP Insurance into their risk management strategies, farmers can protect their livestock investments against unexpected market fluctuations and negative events that can endanger their financial wellness gradually.

One secret benefit of LRP Insurance policy for lasting economic safety and security is the comfort it supplies. With a trustworthy insurance coverage in place, farmers can mitigate the monetary risks associated with unpredictable additional hints market conditions and unexpected losses as a result of factors such as disease break outs or natural catastrophes - Bagley Risk Management. This stability permits producers to focus on the daily procedures of their livestock service without constant worry about prospective economic setbacks

Furthermore, LRP Insurance policy supplies a structured strategy to managing threat over the long-term. By establishing specific protection degrees and choosing appropriate recommendation periods, farmers can tailor their discover this info here insurance coverage plans to straighten with their financial goals and run the risk of resistance, making sure a safe and lasting future for their animals operations. To conclude, purchasing LRP Insurance coverage is a positive approach for agricultural producers to accomplish long-term financial protection and shield their resources.

Verdict

In conclusion, Livestock Risk Protection (LRP) Insurance is a valuable tool for livestock manufacturers to alleviate market threats and safeguard their investments. It is a smart choice for protecting livestock financial investments.